Key UK stocks are in focus as the market opens, with Workspace, Drax, and Avon making headlines. Upcoming results for FTSE 350 and selected international stocks can be found in our companies reporting diary.

1. Workspace hits halfway mark on low conviction asset disposals

Serviced office provider Workspace [LON:WKP] has announced further disposals of low conviction assets as part of its ongoing portfolio strategy. The latest sale will generate £11.8 million in cash, taking total disposals to £106 million toward the company’s £200 million target. Management continues to optimize the portfolio.

2. Drax raises full-year outlook after strong trading

Power generation firm Drax [LON:DRX] released a trading update guiding full year EBITDA toward the upper end of consensus estimates following strong performance. Its capital allocation policy remains unchanged, targeting £1 billion to be returned to shareholders over the next six years.

3. Avon secures $20 million NATO-linked contract

Military-grade respirator manufacturer Avon [LON:AVON] announced a $20.6 million order from a European client via a NATO support and procurement agency. The deal strengthens Avon’s financial outlook for 2026 and beyond.

European Markets Update

Leading European markets are up, bolstered by positive corporate news. The FTSE 100 is up 0.2%, DAX +0.37%, and CAC 40 +0.2%, following reports of expansion in France’s manufacturing sector, the first growth since January 2023.

Highlights:

- Novo Nordisk shares gained nearly 3% after its weight loss drug Wegovy was shown to cut risks of heart attack, stroke, or death by 57% compared to competitor drugs.

- Defence stocks rallied after Norway agreed to purchase at least five UK-built anti-submarine ships in a £10 billion (€11.5bn) deal led by BAE Systems, which rose 1.9%. Babcock International Group jumped over 3%.

Global Markets Snapshot

- Asia: Hang Seng +2.2%, Shanghai Composite +0.5%, Nikkei 225 -1.2%, Kospi -1.4%

- India: Sensex +0.7%

- Commodities: Gold +0.7% ($3,541.90), WTI Crude +1% ($64.65/bbl), Brent +0.9% ($68.10/bbl)

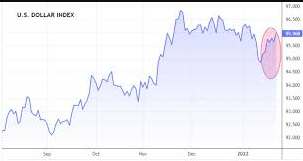

- Currencies: USD/JPY 147.07, EUR/USD 1.1728

Markets may face volatility in the coming weeks due to EU inflation data, US manufacturing reports, EU GDP, US non-farm payrolls, and a potential French no-confidence vote. The ECB monetary policy meeting is scheduled for Thursday.