The White House confirmed on Tuesday that the Trump administration is in discussions over a potential deal that could give the US government a 10% ownership stake in semiconductor giant Intel.

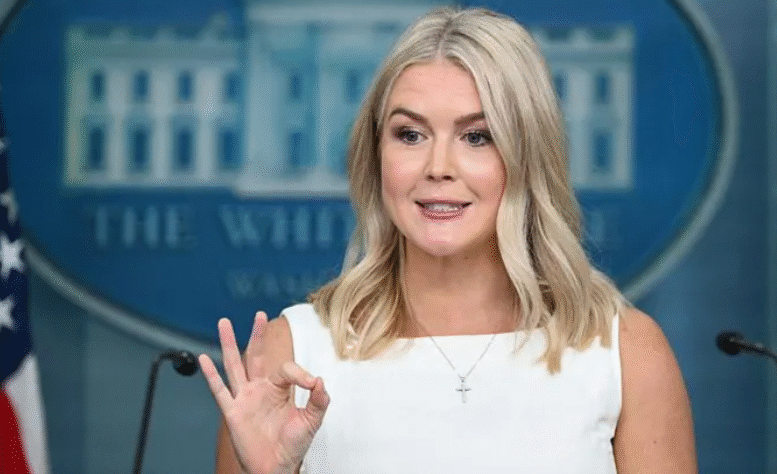

Press secretary Karoline Leavitt said the move reflects President Trump’s priority to “put America’s needs first, both economically and from a national security perspective.”

Commerce Secretary Howard Lutnick revealed that the proposal involves converting government grants into equity shares, rather than providing subsidies outright. “We should get an equity stake for our money,” Lutnick told CNBC, underscoring a shift in how Washington may support domestic tech firms.

The plan, first reported last week, is intended to bolster Intel as it races to catch up with competitors like Nvidia, Samsung, and TSMC, particularly in the fast-growing AI chip sector. Intel, which has struggled to regain its dominance, is also developing a major manufacturing hub in Ohio that could be central to the deal.

Market confidence in Intel was boosted this week after Japanese conglomerate SoftBank announced a $2 billion investment in the company, pushing its shares up nearly 7% on Tuesday.

Analysts say government involvement highlights Intel’s importance as one of the few US firms capable of producing advanced semiconductors at scale. “Securing domestic chip production is a strategic necessity,” said Vincent Fernando of Zero One consultancy.

But critics warn the arrangement could complicate Intel’s turnaround efforts. Dan Sheehan of Telos Wealth Advisors cautioned that mixing political objectives with corporate priorities may “blur the line between commercial discipline and government influence.”

The talks come as Washington tightens oversight of the broader chip industry. Just last week, Nvidia and AMD struck a deal requiring them to hand over 15% of their China revenues in exchange for export licences — an unprecedented arrangement underscoring the high stakes of US tech policy.